How Tax Reform Affects You: Reviewing the 2017 Tax Cuts & Jobs Act

by Mitchell J. Smilowitz, CPA

The Tax Cuts and Jobs Act (TCJA) of 2017, signed into law on December 22, 2017, makes major changes to the tax code. This article provides an overview of these changes.

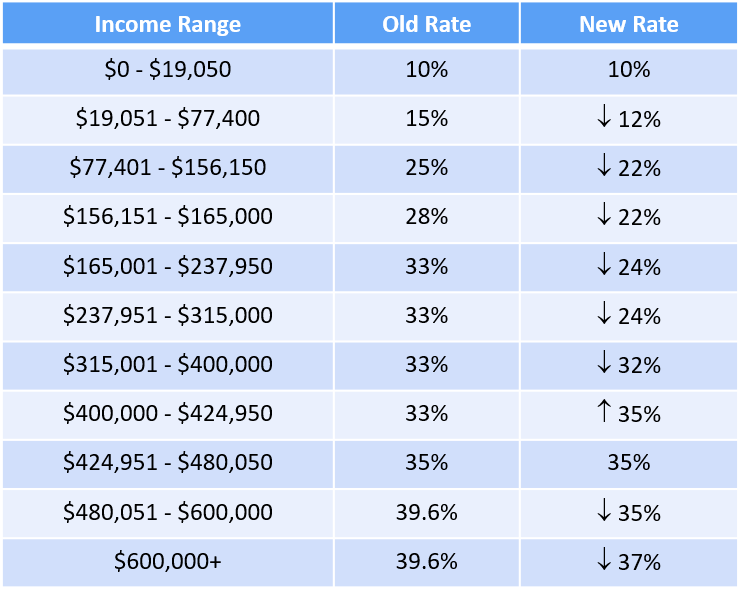

Marginal Tax Rates are lower for most Americans. The TCJA retains seven tax brackets. While the income parameters of these brackets have changed, most tax payers will see some reduction in their marginal tax rate. The following table compares the former marginal tax rates for a married couple filing jointly with the rates established under tax reform.

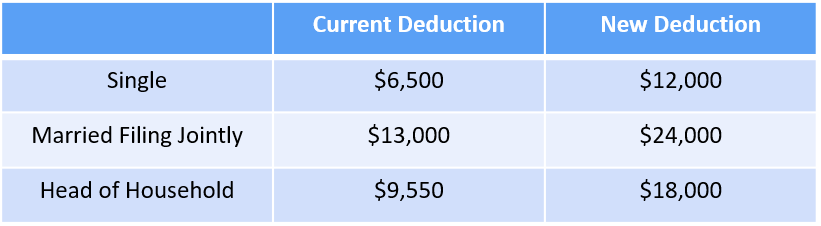

Standard Deductions have increased from $6,500 to $12,000 for single taxpayers; from $13,000 to $24,000 for married taxpayers filing jointly; and from $9,550 to $18,000 for single heads of household. At the same time that the standard deduction has nearly doubled, the personal exemption (previously $4,500) has been repealed.

Many of the rules for Itemized Deductions have changed. One general comment: the increase in the standard deduction is likely to reduce the value of itemized deductions for many taxpayers. Total itemized deductions must exceed the standard deduction before you can claim them.

- The Medical Deduction threshold is reduced to 7.5% of adjusted gross income (AGI) for 2018 but increases to 10% of AGI in 2019. In other words, your medical expenses must exceed 7.5% of AGI in 2018 and 10% of AGI in 2019 and beyond before you can deduct them.

- Mortgage Interest Deduction limits have been lowered from the current $1 million mortgage cap to $750,000. Interest on home equity debt is no longer deductible.

- The deduction for State and Local Taxes (SALT) has been reduced significantly. Beginning in 2018, the SALT deduction is capped at $10,000 for property taxes, state and local income taxes or state and local sales taxes combined. Previously, the total amount of all SALT taxes could be deducted from income.

- While the deduction for Charitable Contributions increases from 50% to 60% of AGI, the value of the deduction may decrease for many taxpayers. Many analysts believe that the increase in the standard deduction may minimize the value of the charitable contribution for many taxpayers. This could impact synagogue budgets which depend on charitable donations.

- The Moving Expense deduction is repealed except for members of the military. Similarly, reimbursements for moving expenses must be included as income for tax purposes. This will affect both clergy and non-clergy employees who have to relocate for a new job.

- The Mileage Deduction for driving for charitable purposes remains at 14 cents per mile.

- Miscellaneous Deductions, such as unreimbursed employee business expenses and tax preparation fees, are eliminated.

The Child Tax Credit has been increased and expanded. The TCJA boosted the tax credit from $1,000 to $2,000 per qualifying child. At the same time, the income level for claiming the child tax credit jumped from an AGI of $75,000 single and $110,000 married to $200,000 and $400,000, respectively. Those with little or no tax liability can receive a refund up to $1,400 per child. Taxpayers who care for others can claim an additional $500 credit for dependents.

529 Plans, previously reserved for tax-deferred investing for college expenses, can now also be used for elementary and secondary school expenses (up to $10,000 per year). This may benefit taxpayers who send their children to private or religious day schools.

There are significant changes to the Estate and Gift Tax. The TCJA more than doubles the lifetime exclusion on transfers of property, such as gifts and estates, to $11.2 million. The lifetime exclusion will be adjusted for inflation. The annual gift tax exclusion has been raised to $15,000 per recipient.

The TCJA retains the Alternative Minimum Tax (AMT) but increases the threshold at which it goes into effect to $109,400 for married couples filing jointly, $70,300 for all other taxpayers.

The Individual Mandate for health insurance coverage established by the Affordable Care Act has been effectively eliminated. While the mandate still exists, the penalty for not having insurance has been reduced to $0. This change takes effect in 2019.

The impact of these changes on your 2018-and-beyond taxes is likely to be significant. Please note that these changes, which apply to individuals and married couples, sunset in 2025. While the JRB can provide guidance and education on the changes resulting from tax reform, we recommend that you consult with your tax advisor to determine how the Tax Cuts and Jobs Act is likely to affect your personal situation.