JRB Target Date Fund Options

JRB Target Date Fund Options

Target Date Fund (TDFs) are a popular choice for many participants. The JRBs Fidelity Freedom Commingled Pool investment options offer a simple solution for those with:

- A long-term perspective,

- A desire for a diversified portfolio,

- An appreciation of the importance of rebalancing assets as one approaches retirement, and

- Little interest in, willingness and/or time to manage their own portfolio.

Key Target Date Concepts

- Target Date. Target Date Funds are designed to grow assets with a targeted retirement date in mind. TDFs generally employ a fund of funds investment strategy rather than purchasing the stocks of individual companies. Over time, TDF managers rebalance assets to align with participants’ time horizon to retirement. In other words, the investment objective of a TDF typically moves from a focus on growth in the early years to a focus on capital preservation and income as the target date approaches. You select the TDF with the target date closest to the year you plan to retire.

- Glide Path. The shift of assets over time is called the glide path. TDF managers use the target date to determine the degree of risk the fund is willing to accept at a specific point in time. The longer the time horizon, the more heavily weighted toward high-performing, but riskier, assets such as domestic and global equities. As the time horizon shortens, fund managers automatically rebalance assets to more conservative investments such as bonds and cash.

- To or Through? A Target Date Fund may be designed to take you “to” or “through” retirement. A “to retirement” TDF generally reaches its most conservative asset allocation on the target date. After that date, the allocation typically does not change. A “through retirement” TDF continues to rebalance past the target date. These funds continue to decrease exposure to equities and increase investments in bonds and cash after the target date. The Fidelity Freedom Commingled Pool options continue to rebalance through the target date.

- One-Stop Investment Solution. Because TDFs offer a balanced, diversified portfolio that adjusts over time, they are designed to cover all of an investor’s long-term investment needs. TDFs are designed to be your sole investment; you don’t need to invest in other funds.

- The Challenge of Insufficient Savings. Reaching the target date does not mean you’ve saved enough to meet your goal. Whether or not you meet your retirement savings goal depends on when you started to invest, how much you contributed and other sources of retirement income you may have. Please contact the JRB to see if you are on track for retirement. Or, for an estimate of your progress, see this article.

Fidelity Freedom Commingled Pool

The Fidelity Freedom Commingled Pool is a family of Collective Investment Trusts (CITs) that offer target date options in 5-year increments from 2010 through 2065 as well as an Income Fund option for those in retirement.

- Investment Objective. The investment objective for all Fidelity Freedom Commingled Pool options are broadly similar – to seek high total return until its target retirement date.

- Strategy. Each TDF is designed for investors who anticipate retiring in or within a few years of the fund’s target retirement year. Each Fidelity Freedom Commingled Pool invests in a range of Fidelity CITs: domestic (U.S.) equity funds, international equity funds, bond funds and short-term funds.

- Through Retirement. The asset allocation adjusts over time until it reaches an allocation of approximately 20% equities and 80% bonds and cash about 20 years after the target date.

View JRB Investment Returns Sheet

Fidelity® Freedom Income Commingled Pool D Fact Sheet

Fidelity® Freedom 2010 Commingled Pool D Fact Sheet

Fidelity® Freedom 2015 Commingled Pool D Fact Sheet

Fidelity® Freedom 2020 Commingled Pool D Fact Sheet

Fidelity® Freedom 2025 Commingled Pool D Fact Sheet

Fidelity® Freedom 2030 Commingled Pool D Fact Sheet

Fidelity® Freedom 2035 Commingled Pool D Fact Sheet

Fidelity® Freedom 2040 Commingled Pool D Fact Sheet

Fidelity® Freedom 2045 Commingled Pool D Fact Sheet

Fidelity® Freedom 2050 Commingled Pool D Fact Sheet

Fidelity® Freedom 2055 Commingled Pool D Fact Sheet

Fidelity® Freedom 2060 Commingled Pool D Fact Sheet

Fidelity® Freedom 2065 Commingled Pool D Fact Sheet

How Fidelity Freedom Commingled Pool investment options Allocate the Mix of Investments

Younger investors have a long time horizon. They can benefit from the growth potential of equities and other long-term assets when building their retirement savings. These are key saving years; it’s important to start early to take maximum advantage of compounding.

Middle-aged investors with an established career still have a relatively long time before their expected retirement date. Maintaining a high allocation to equities and continuing to increase their savings rate may be appropriate to help them pursue their retirement goals.

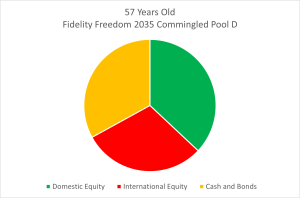

Investors close to or at retirement will start to see a gradual decrease in their strategy’s equity allocation and an increase in bonds and cash. Growth during this period is still very important, but as investors enter retirement, the target date strategy addresses the need for less risky assets.

Conclusion

Target Date Funds provide a useful alternative for investors who want to achieve financial security but have little interest or time to manage their long-term investments. The Fidelity Freedom Commingled Pool CITs offer a diversified portfolio that adjusts over time to reduce risk. Choose the Fidelity Freedom Commingled Pool investment option with the date closest to the date you plan to retire.

Please contact us at 888-JRB-FREE (572-3733) or email us to discuss your asset allocation or any other investment questions you have.

December 2025